reverse sales tax calculator nj

Input the Final Price Including Tax price plus tax added on. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a.

How To Calculate Sales Tax Backwards From Total

New Jersey sales tax details.

. Reverse Sales Tax Calculator - 100 Free - Calculatorsio. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. How to Calculate Reverse Sales Tax Following is the reverse sales tax formula on how to calculate reverse tax Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Fast and easy 2022 sales tax tool for businesses and people from Atlantic City New Jersey United States.

You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202122. New Jersey State Tax Quick Facts. Reverse Sales Tax Calculator Remove Tax.

57 the New Jersey Sales and Use Tax rate was reduced in phases between 2017 and 2018. If playback doesnt begin shortly try restarting your device. That entry would be 0775 for the percentage.

242 average effective rate. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Jersey local counties cities and special taxation districts. Certified businesses within Urban Enterprise Zones may purchase.

Instead of using the reverse sales tax calculator you can compute this manually. Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs. Order Now Offer Details.

Find your New Jersey combined state and local tax rate. The Garden State has a lot of things going for it but low taxes are not among its virtues. Feature 1 is a helpful tool for a property owner to determine if they would like to pursue a tax appeal.

NJ Real Estate Taxes - Calculator for Tax Appeal. Instead of using the reverse sales tax calculator you can compute this manuallyTo find the original price of an item you need this formula. Input the Tax Rate.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax. The New Jersey NJ state sales tax rate is 6625. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

This script calculates the Before Tax Price and the Tax Value being charged. Please check the value of Sales Tax in other sources to ensure that it is the correct value. It is 429 of the total taxes 379 billion raised in New Jersey.

Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. Please note state sales. Please check the value of Sales Tax in other sources to ensure that it is the correct value.

Unlike many states NJ does not allow the imposition of local sales taxthe entire state has a single rate. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Reverse sales tax calculator 2017 Verified 3 days ago Url.

Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663. 6625 on sales made on and after January 1 2018. The NJ sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price.

OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. To find the original price of an item you need this formula. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law.

Reverse Sales Tax Calculator Remove Tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Input the Final Price Including Tax price plus tax added on.

Sales and Gross Receipts Taxes in New Jersey amounts to 163 billion. There are times when you may want to find out the original price of the items youve purchased before tax. Videos you watch may be added to the TVs watch history and influence TV.

Enter the sales tax and the final price and the reverse tax calculator will calculate the tax amount and price before tax. New Jersey has a 6625 statewide sales tax rate and does not allow local governments to collect sales taxes. The base state sales tax rate in New Jersey is 6625.

There are however 32 Urban Enterprise Zones covering 37 economically distressed cities. Reverse Sales Tax Formula. 1050 cents per gallon of regular gasoline 1350 cents per gallon of diesel.

Order Now Offer Details. New Jersey Sales Tax Calculator calculates the sales tax and final price for any New Jersey. Free online 2022 reverse sales tax calculator for Atlantic City New Jersey.

The feature utilizes the same algorithm method used by many New Jersey Licensed Appraisers to determine the municipalities equalized value of a property. The reverse sales tax calculator is the easiest and very handy calculator for computing the actual price if you input the sales tax rate and the sale price you paid for a good or service. Simply enter the costprice and the sales tax percentage and the NJ sales tax calculator will calculate the tax and the final price.

OP with sales tax OP tax rate in decimal form 1. Sales and Use Tax. We can not guarantee its accuracy.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. New Jersey sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Before January 1 2017 the Sales Tax rate was 7.

Finding how much sales tax you paid on an article is quite easy but knowing the actual cost requires a reverse calculation. This script calculates the Before Tax Price and the Tax Value being charged. Reverse sales tax calculator for Atlantic City New Jersey.

6875 on sales made between January 1 2017 and December 31 2017. Input the Tax Rate. Enter the sales tax percentage.

We can not guarantee its accuracy.

How To Calculate Sales Tax Backwards From Total

2020 Used Land Rover Range Rover Sport Turbo I6 Mhev Hse At North New Jersey New York Auto Group Nj Iid 21249935

How To Pay Sales Tax For Small Business 6 Step Guide Chart

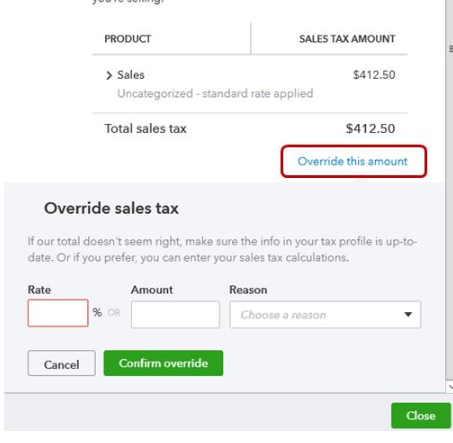

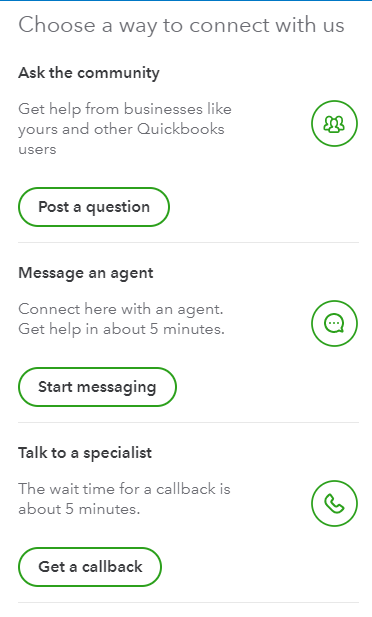

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

2022 New Audi A4 Sedan Premium Plus 40 Tfsi Quattro At Turnersville Automall Serving South Jersey Nj Iid 21123349

1031 Exchange Rules What You Need To Know For 2022

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

2018 Used Toyota 4runner Trd Off Road 4wd At North New Jersey New York Auto Group Nj Iid 21131370

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator De Calculator Accounting Portal

24 Hogan Ct Little Egg Harbor Township Nj 08087 Realtor Com

2021 2022 Tax Brackets Rates For Each Income Level

How To Calculate Sales Tax Backwards From Total

How To Pay Sales Tax For Small Business 6 Step Guide Chart

How To Calculate Sales Tax Backwards From Total

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System